Chapter 8 – Get Deeper Insights

Here is Chapter 8 from our very well-received, 32-page E-Book –Benefiting from VaR – Quick Guidelines for Commodity Risk Practitioners. A quick recap for those who’ve read and enjoyed it, and for those who haven’t yet read it, you can download it now from here ! The E-Book is written for Commodity Risk Practitioners who are just starting with a Risk Function as well as those who have a ready set-up and are looking for better ways to leverage on that.

Chapter 8 – Get Deeper Insights

As Businesses evolve, their need for deeper insights grows exponentially. Companies where technology doesn’t keep the same pace, end up overburdening their teams with increasingly meaningless, manual work and creating yawning gaps in business insights.

Use Different Perspectives

If you’re looking for deeper insights into your business, looking at just risk by commodity is not enough. While for smaller businesses that are run with just commodity perspectives its sufficient, for larger businesses there are multiple other levers that are utilized for growth, such as Business Units, Strategy, Division, Legal Entity, etc. Just as most organizations look at P&L from these perspectives, it is also important to look at risks from these. This is most helpful for organizations with a Matrix Hierarchy – where Product and Region / Business Unit are the 2 main axes. Each product is traded across regions / business units, and each business unit / region trades multiple products.

At the very least, it involves everyone across various departments in the organization in risk management activity. A Business Unit Head looks at risks for commodities within his business unit. The head of trading looks at risks through the Strategy and Commodity looking glasses, and so on.

Here’s an Example…

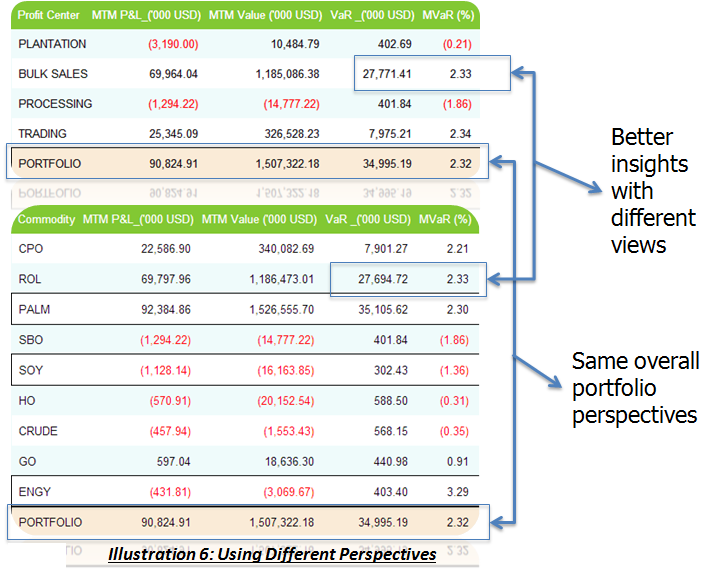

Consider the two perspectives in illustration 6 below.

The 1st perspective is of Business Unit / Profit Center, while the 2nd is of Product / Commodity. Notice how the final portfolio is the same for both the perspectives, but individually they give completely different view-points, both correct ! Combined together, it could be concluded (as one of the viable choices) that position in Product “ROL” needs to be cut under Profit Center “Bulk Sales”.

Use Trend Insights

Trends are one of the best ways to get deeper insights into trading and risk management. Various trends will give different insights:

Trends are one of the best ways to get deeper insights into trading and risk management. Various trends will give different insights:

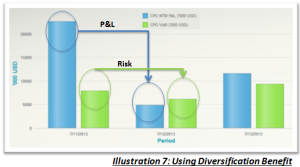

Apart from these, a trend of combination of meaningful parameters, like P&L and Risk, will show the result of trade-offs done between reducing / hedging positions and doing nothing. As an example, the illustration below shows how during 2 days, the P&L reduced sharply without much reduction in risk. These kind of instances should be probed further.

Conclusion

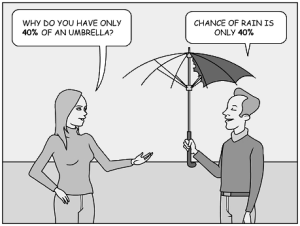

Just like you don’t take 40% of the umbrella with you, you should not also be less than 100% prepared for Risk Management. And remember, it is a process, you keep getting better at it. With heightened regulations and increasing volatilities, good Risk Management is going to be a key differentiator between growing and de-growing companies.